Anfragen an:

Anfragen an:

We can only pay your invoice if it meets our requirements. Therefore, please ensure that you provide all the information listed in the sample invoice and follow the guidelines below:

Feel free to use our invoice template and replace the placeholders with your actual details.

As these are international payments, it is essential that you provide your IBAN so that we can process the payment fast and without any delays or errors.

If you do not know your IBAN, there are several easy ways to find it out:

When you create your invoices using the Courier Exchange invoicing tool, the bank details are specified as stored in your profile. For partners from the UK, this is usually in the form of the sort code and account number. However, we require the IBAN.

To ensure smooth processing and payment, please note the following:

If needed, you can download our blank CMR form here.

Send an email with all information and attachments required:

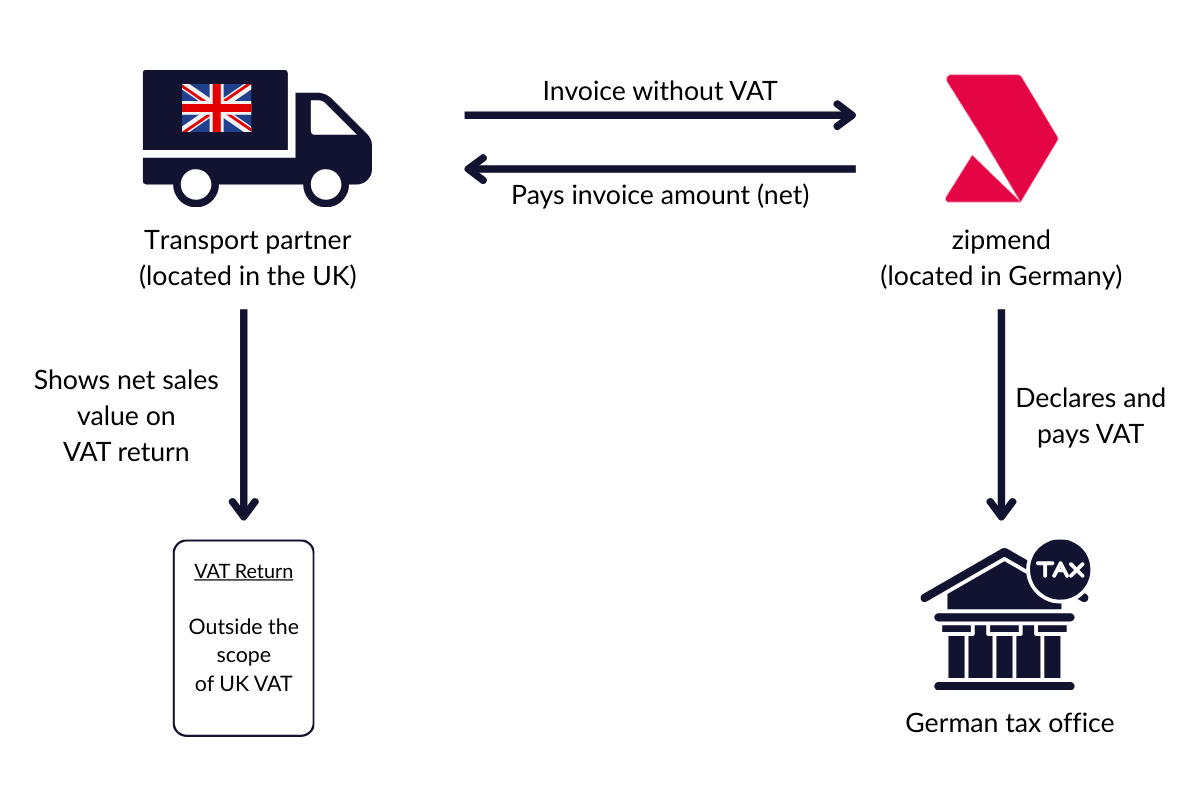

No, you do not have any disadvantages.

The only difference is: you must not add UK VAT on your invoice.

The reverse charge applies to all companies based outside Germany who are VAT-registered businesses or self-employed.

UK sole traders (self-employed)

UK Limited companies (Ltd.)

LLPs or other partnerships

If you are VAT registered in the UK, you still have to include these sales in your VAT return.

You do not charge UK VAT on the invoice, and you do not pay VAT on it in the UK.

These transactions are marked as “outside the scope of UK VAT”.

If you are not VAT registered, nothing changes in your VAT return (because you do not file one). You only declare the income in your Self Assessment or Company Tax Return as part of your normal business profits.